It’s time to get serious about the service you deserve! No more waiting on hold, navigating phone trees, or working with an agent that doesn’t know your business or understand your payroll services needs.

Say “NO!” to lying awake at night worrying if your payroll services needs have been met. Working with a dedicated specialist gives you the peace of mind and compliance assurance you need to sleep at night.

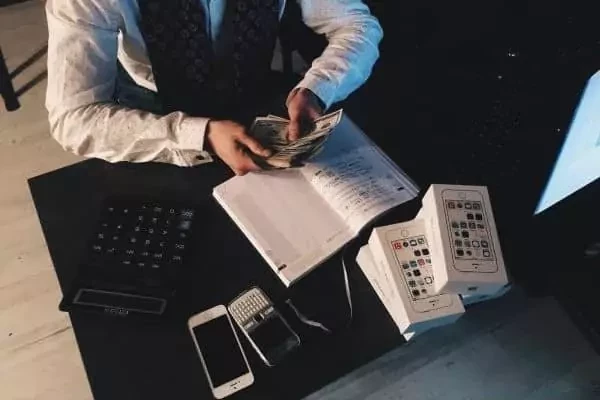

By outsourcing your payroll & HR tasks, you are putting more time in your day and most importantly, pledging that your employees are paid on time and correctly.

Outsourcing payroll tasks sets you up to manage and build your company’s financial health so you can attract and maintain talent that will grow your business.

It’s time to give yourself a well-earned break. Contact your local Payroll Vault for expert payroll services support!

When you outsource your payroll services needs, you are maximizing your time so you can focus on growing your business by attracting & retaining valuable team members.

We offer scalable options for payroll services for your unique business needs. You can rest easy knowing that your payroll taxes are filed accurately and on time.

We make it easy for you to track employee hours and stay on top of scheduling changes quickly and efficiently. We offer a variety of features that allow you to control and reduce labor costs.

That provide you with a dedicated and reliable source to handover detailed and compliance driven HR related work and tasks.

A comprehensive program, so you can reduce the risk of fraud, poor work ethic, and criminal activity. Now you can be proactive about safeguarding your company’s reputation.

Improve cash flow and financial accuracy by removing monthly or quarterly audit reports.

Payroll Solutions

Payroll Solutions

Workforce Management

We employ executive level partners and services which include: HR Support, Time Keeping, Worker’s Comp, Background & Drug Screening, and Labor Poster Services.

Workforce Management

We employ executive level partners and services which include: HR Support, Time Keeping, Worker’s Comp, Background & Drug Screening, and Labor Poster Services.